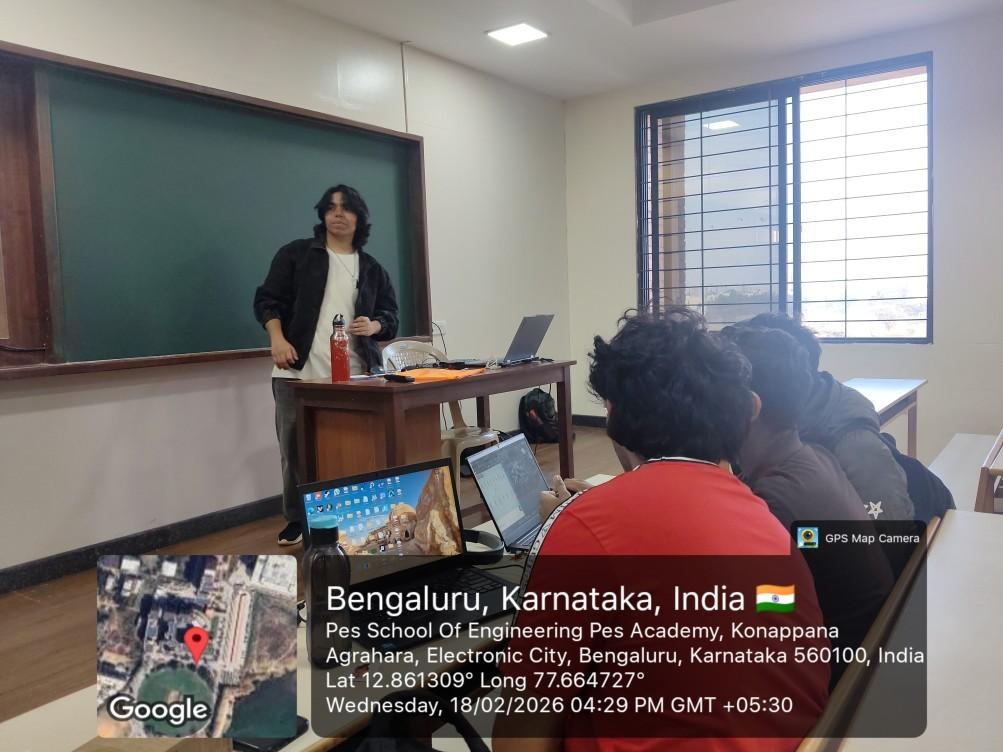

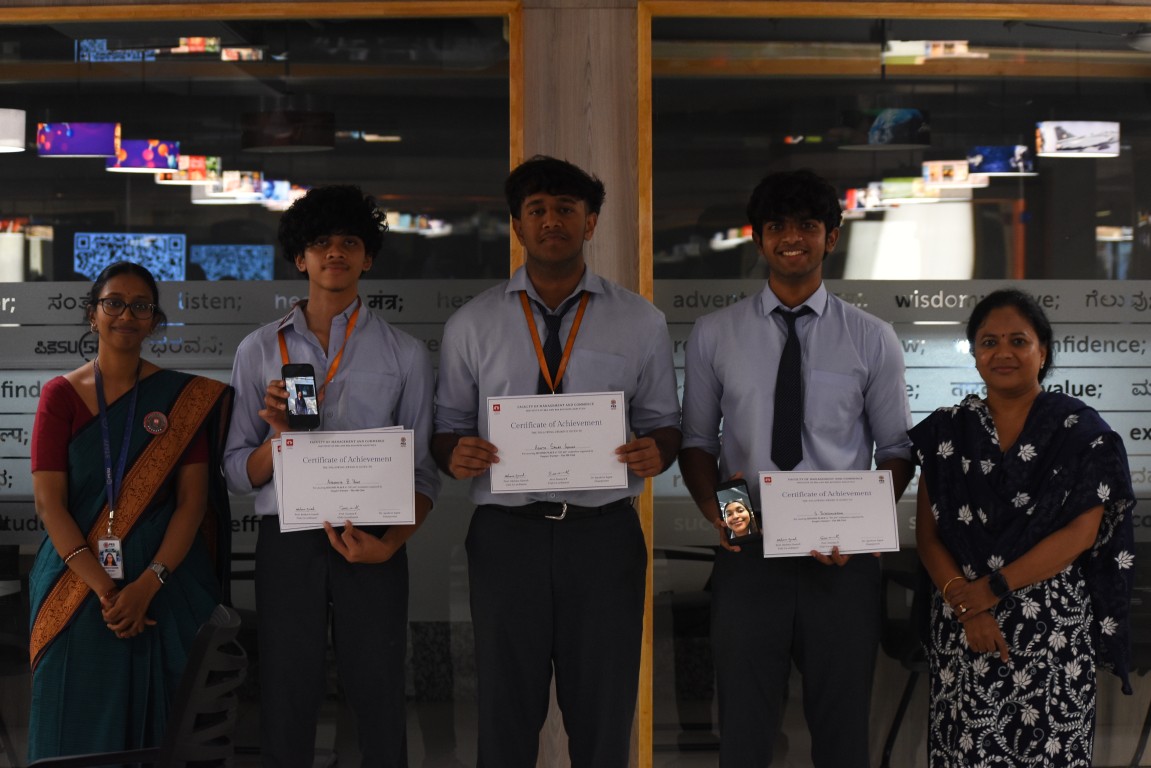

Seminar on Managing the value of the Rupee – Appreciate or Depreciate on 20 Nov 2018

PES University had organized a seminar on Managing the value of the Rupee-Appreciate or Depreciate. Two eminent speakers presented their views on the topic. Padmashree awardee Shri Manoharan, Chairman of Canara Bank and one of the illustrious bankers of the country, spoke on the fiscal prescriptions for managing the rupee. The other eminent speaker, Dr. Abdul Aziz, a celebrated economist and Chair professor at the National Law School, Bangalore, deliberated on the economic impact of a depreciating rupee. Dr. M. R. Doreswamy, Chancellor of PES University, presided over the function.

The gist of the two talks is given below:

The value of a currency symbolizes the economic strength of a country. Is there an ideal value of the rupee? There are a myriad number of levers driving the rupee value, most of them not in India’s control. The elephant in the room, clearly, is crude price, a key driver of the value of the rupee. India imports 80% of its oil requirement. A weak rupee will make oil imports dearer, stoking inflation. The crude price itself is subject to forces such as globaleconomic growth, OPEC’s policies, US shale production, international sanctions and political turmoil in countries such as Venezuela.

On the other hand, if the US Fed increases interest rates, dollars leave India, further plunging the rupee value. A depreciated rupee increases our Current Account Deficit (CAD). The remittances of the Indian diaspora limit the CAD, but remittances remain unstable due to the turmoil in the Middle-East. A weak rupee does bolster our exports; so, a depreciated rupee is not necessarily all evil. In fact, export-intensive countries such as China and Korea, as a matter of state policy, hold their currencies to boost exports; the US bills them “currency manipulators”. The flip side is that a strong rupee also poses problems; exports become uncompetitive although the import bill reduces. A strong rupee does ease the burden on external borrowings.

To be fair, most major currencies have depreciated against the dollar. The rupee depreciation seems steep, but in real terms, IMF feels the depreciation is less than 6% in the last six months. High growth rates of the country and modest levels of external debt favour India in keeping the value of the Rupee in check. The other salutary issue is India’s healthy foreign exchange reserves, although the stated policy of the RBI is not to chase a specific target of the rupee but limit its volatility. Market forces largely determine the rupee movement in India within a band.

Foreign Direct Investment (FDI) is growing at a strong clip and helps in stabilizing the rupee; the colour of FDI money is much better than that of fickle FII investments as it creates enduring assets for the country. The recently concluded deal with Japan on currency swap provides some additional cushion. The economic impact of a weak rupee was dwelled upon by the speakers. The impact of depreciated prices on the common man, such as higher fuel costs, was delineated. The speakers expounded on the impact of a weak rupee on India’s economic growth trajectory, per capita income, inflation control, and job creation.

- #Event

- November 28, 2018

- Viewed - 4618

- Liked - 1