Expert talk on corporate innovation through finance partnerships

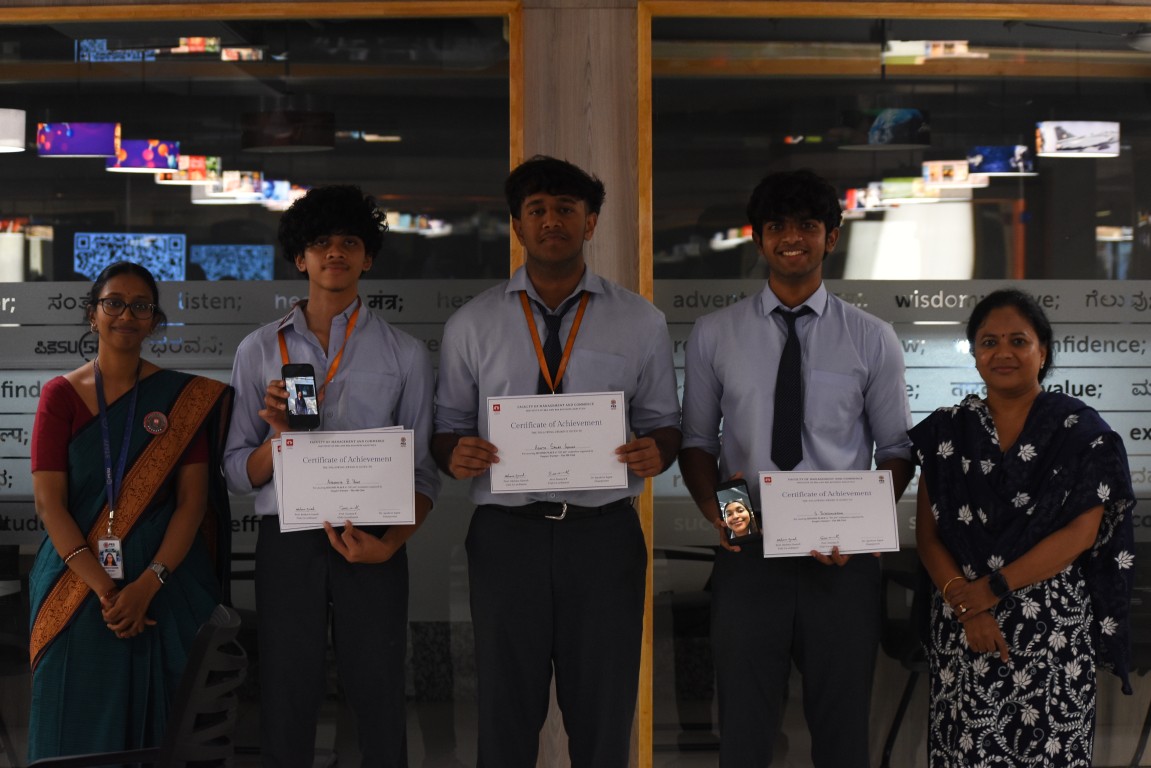

The role of finance is evolving to enable corporate innovation. Shobana Rajagopal drew from her experience as the revenue controller in Microsoft India and shared her understanding of digital transformation in finance partnerships. Speaking about how COVID has affected industries and its core operations around the world, she observed that acceleration of technology that should have happened in a time span of ten years happened in one year. This probably happened due to the unavoidable circumstances which pushed industries to work on technology and digital transformation as soon as possible. In the context of industrial revolution 4.0, the transformation process involved engagement of customers through products and services with great customer experience, empowering employees by up-skilling them with the newest technologies, optimising operations by segregating repetitive tasks to automated systems and finally transforming products to become more digitally equipped. The process of growth involves hyper scale, hyper flexibility and hyper security. Innovation includes augmented and mixed reality where the objects residing in the real world are enhanced by computer generated perceptual information, machine learning which consists of computer algorithms that can improve experience automatically through the use of data. In the area of finance, statistical models are used to make predictions, detect frauds and provide financial advisory services to the stakeholders. As a result, intelligent products and services have evolved. The technology imperatives in the field of finance include: automation and robotics, data visualisation, advanced analytics and perspective analytics. An example of real time financial info is using MS excel where emphasis is on consumption of data and the best way to deliver insights. Advanced analytics for finance operations is about the optimisation of algorithms and knowledge of tools. Perspective analytics for business and sales operations focuses on the organisational health and the move from telling stakeholders from what happened to what will happen. As stakeholders are resistant to change – the best way to deal with change is to deal with it. In the past financial functions included: book-keeping, payables and receivable, reporting and controls and tax and compliance. In the present situation, it has evolved to be more of strategic planning, treasury and working capital management, capital budgeting, risk management and corporate strategy. Given the example of Amazon, they are doing well in terms of R&D, strategies and business development act as key contributors. Digitalization, adoption of new technology, bots and algorithms are important to stay competitive. Equally important are building a digital financial function with clear vision of expected targets, link to overarching business strategy, bridging skill gaps which is current capability versus modern finance, refining competency models and finally adhering to companies’ securities standards. Reimagining the finance work force in an agile operating model where finance teams can quickly share expertise when needed most is critical to the organization's success. The diverse set of views might deviate a bit but new ideas might spark which would help in the long term. Ms. Shobana Rajagopal, qualified Chartered Accountant and experienced corporate executive delivered the expert talk hosted by department of management studies on February 22, 2022.

- #Innovative

- February 24, 2022

- Viewed - 3277

- Liked - 2